The COVID-19 pandemic has put a great strain on business owners and employees alike. Many employers feel stuck, wondering how they can keep their company afloat while still paying their employees and giving them the healthcare that they may need now more than ever. The solution to these issues may be found inside their benefits plan, but it takes a knowledgeable adviser to unlock these savings opportunities.

The more your adviser works with your business, the greater the likelihood that they’ll be able to help it adapt to all the challenges surrounding us.

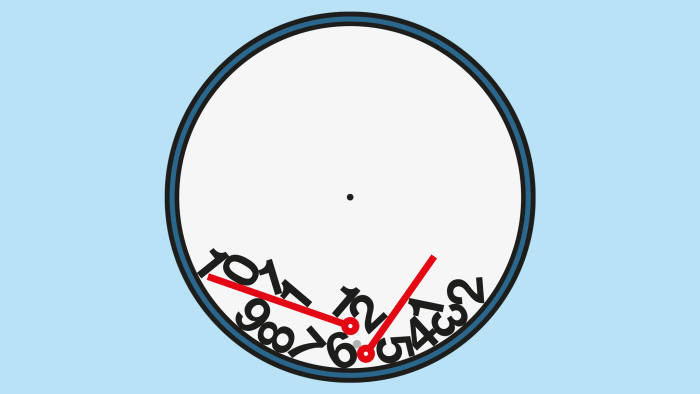

A Year-Round Discussion

A great adviser will stay in touch with you over the course of the entire year to ensure that the plan you have is still the plan that’s best for your business. An adviser who keeps up-to-date with your business can help your plan evolve with your company, which is highly valuable during the best of times. When an unexpected health crisis happens, though, this familiarity with your company can help your business bounce back faster as well.

An adviser who interacts with your business from January to December will have a far better understanding of your company’s needs, goals, and resources than a broker who only reconnects with you when it’s time to renew. When money gets tight and employees need to depend on their benefits plans more than ever, an adviser who has seen the ups and downs of your business can come up with tools and strategies that can help your company and employees make it through complicated times.

Connecting With Employees

Employee education is crucial to an effective, cost-saving benefits plan. If your adviser is truly making the effort to get to know your business and the people in it, they’ll create an interactive and personal experience for your workers through means such as:

- One-on-one meetings to answer employees’ questions about their plan

- Group meetings with your company to introduce or explain new tools and strategies

- Remote educational tools that allow employees to access benefits information from anywhere

The more comfortable your employees are with your adviser, the more likely they’ll be to take their recommendations when faced with widespread health or financial challenges. Plus, when you know that your adviser has made the effort to connect with your employees, you can rest easy knowing that they see your workers as people rather than numbers in a system.

Adjusting to Changes

Even the best advisers can rarely make big benefits changes happen overnight. A great adviser, however, will build you a flexible plan that can be altered over time based on your business’ needs. Working closely with your adviser and giving them insight into the inner workings of your company can facilitate their efforts to change your plan based on what you and your employees need most.

If your adviser knows your business well enough to know where to create more savings opportunities, you can then allocate those savings to employees who need help paying their bills. Or if your business is struggling through this time, those savings could go toward keeping your company afloat while preventing layoffs. An adviser who knows your business well can find hidden quality and savings opportunities that other brokers may overlook.

Putting People First

An adviser with a human-first approach can greatly improve your employees’ experience, even during times of adversity. If your adviser gets to know your company all year long, interacting with employees and demonstrating their ability to adapt your plan to changes, you and your workers will be much better equipped to handle whatever challenges your business may face.

Contact us today to learn more about how your adviser can help make this challenging time easier for you and your employees.