“Liars figure, and figures lie”. When I was a kid, I remember seeing this on a plaque in the clubhouse of a golf course I worked at. Now, as an adult in the healthcare industry, these words really ring true.

Medical loss ratio, a part of the healthcare reform, requires insurers to spend a specified percentage (80 percent for small-groups and 85 percent for large-groups) of total premiums on medical costs and expenses that improve healthcare quality. If these requirements aren’t reached, the insurers must issue rebates to their customers.

On the surface this sounds good, and that was the intent. What it might have done though, is accelerate rate increases significantly, causing a runaway increase in premiums for a couple of reasons.

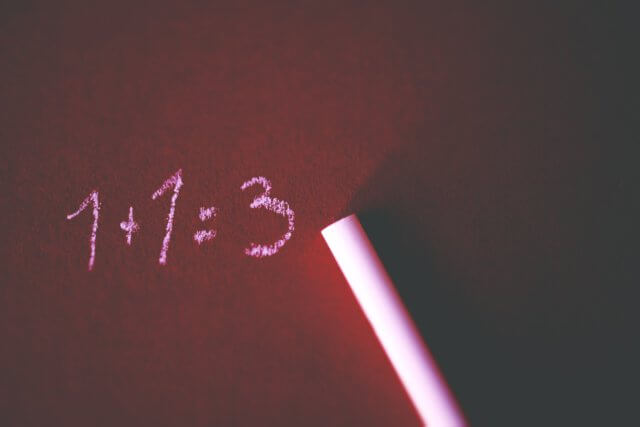

The figures lie

Some insurers may have difficulty meeting solvency requirements. For example an insurance company could have been making a 25 cent margin on each dollar, but to make that 25 cents again, they then have to make that dollar 1.50.

Profits still need to be made for the insurers bills to be paid. And since healthcare utilization has decreased during the pandemic, some large healthcare companies may not spend the required 85 percent on claims or claim-related expenses.

In 2020, a Pennsylvania insurer didn’t spend what they expected on claims in one of their smaller business blocks during COVID because people reduced their use of services. Recently employers have been receiving large MLR (Medical Loss Ratio) refunds which on the face of things seems good.

Before medical loss ratio rule came into effect, insurers could accumulate a reserve from these low-claim years to pay for the claims in high-claim years. Now, to overcome paying rebates and build up these needed reserves, this company, and many more, may need to increase premiums.

At first glance, rebates look beneficial for employers — but long term, the numbers don’t add up.

And liars figure

Other insurers see an incentive to inflate the expense of premiums, because when they keep your costs up, they make more money. Premiums are calculated based on the average amount of medical claims made over several years. When this number is estimated a large profit can be established, even if there are rebates to be issued.

On top of increasing premiums, big healthcare companies have found a way to bury expenses by using the pharmacy manager they control. Pharmacy can increase prices and charge the insurer, and because pharmacy is an expense, it isn’t reportable and the insurer can keep their margins.

This is legal, but devious and works against employers and their people. And although these large companies are legally required to look out for your best interest, profit is still their focus, not giving your people the best care at the best price possible.

Where does that leave employers?

Understanding that even well-intentioned policies like medical loss ratio don’t actually protect you is just the beginning. You want to know that your benefits plan is providing maximum value for your employees based on the plan you have budgeted.

To do this you need to review your plan continuously and with the help of someone that knows the ins and outs of the healthcare industry. Even if you are happy with the insurer you have, a review of your plan is still warranted.

An advisor can help pull back the curtain to show you how these policies really work and what is actually happening behind the scenes.

Healthcare is very opaque. Realistically the medical loss ratio created the ability to make it look like the numbers are in your favor, but they aren’t. If insurers tweak the figures enough, they can still win.

“Liars figure, and figures lie”, this is a numbers game and the house will always win until you take the game off their turf.