The calendar for a typical benefits plan is usually pretty unremarkable: your broker meets with you at the end of the year to discuss your renewal, at which point you can have a discussion about changes that should be made in your benefits plan. Then, you sign off on your plan for another year and don’t speak with your broker until it’s time to renew once again.

This practice has been the industry standard for years, but with a great benefits adviser, your business can depart from the status quo and, in the process, build a benefits plan that functions at your speed. By forgetting the notion that all changes to your plan have to be made at the end of the year, you and your adviser can construct a plan that evolves with your business while alleviating a source of unnecessary stress for you.

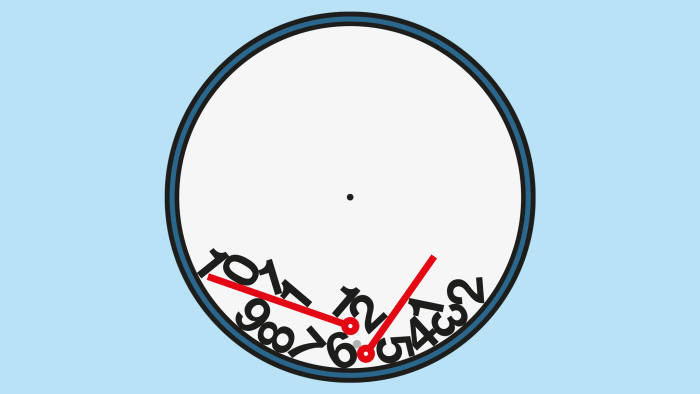

Here’s why you shouldn’t feel pressured to make all the changes to your benefits plan at a specific time of the year:

Removal of the Rush

Your benefits plan is one of your largest business expenses, and it deserves to be treated as such. Just as you wouldn’t hurry into buying a house or a car without carefully considering all your options, your plan should be thoroughly analyzed before you simply accept proposed changes to it at the end of the year.

If you feel pressured to change your benefits plan simply because your renewal is approaching, consider holding off until you feel ready to make the changes your adviser believes your plan needs. You can make changes to your plan at any time during the year, and there’s no reason to force them all to happen at one time if your business isn’t ready for them yet.

Timing That Works for You

A great benefits plan isn’t one-size-fits-all. Your adviser should be working to create a plan that’s uniquely tailored to your company’s needs, and that includes making changes when your business needs them. Making changes at the end of the year is typical for brokers who follow the traditional standards that say that the same plan can work for numerous vastly different businesses, but the truth is that you can change parts of your plan at any point during the year.

Your adviser should be working with you year-round to monitor how your business evolves. As they get to know your company and how it’s growing, they’ll be able to give you recommendations on what changes to make and when. This personalized advice can help you alter your plan the right way, avoiding risky changes being made too soon or necessary changes being made too late.

A Holiday Tradition You Can Forget

The holidays are a stressful enough time for business owners (and their employees). In addition to dealing with all of the end-of-the-year challenges for your company – one of which is your plan renewal itself – you may also be focused on staff holiday parties, employees getting eager about time off, and your own personal holiday preparations outside of the workplace. The end of the year is a busy, but exciting time, and feeling like you need to add benefits plan changes to your already packed schedule may just add unnecessary weight to your shoulders.

By avoiding the holiday business bustle, you can save your plan changes for a time before or after one of the most stressful periods of the year. Don’t feel pressured to make big decisions about your plan during a time when you should be looking forward to seeing your family and celebrating the emergence of a new year. If the tradition of end-of-the-year changes isn’t for you, you have another eleven months to make big decisions about your plan.

The Right Time for the Right Plan

Whether you feel that waiting to make changes or avoiding the wait is right for your plan, you should never feel pressured into changing your plan at a certain time of the year just because it’s how it’s always been done in the benefits industry. In fact, more customized timing can remove additional stress from the holiday season while helping you build a plan that works better for your business specifically. Like many other aspects of traditional benefits plans, the status quo for changing up a company’s plan isn’t always the best strategy, and your adviser can help you make changes when you need them the most.

Contact me today to learn more about how making changes at the right time can help your benefits plan do more for your business.